Segment Y in the press

- Nepal's EV surge - 76% of passenger vehicles electric amid rapid shift

- The future of electric vehicles may ride on two wheels

- Chinese carmakers push to go global

- India's spending spree slows as debt problems become more widespread

- India's manufacturing sector benefits from China's challenges

- Uber's tricky vision aims to tempt Indians from car ownership

- Mahindra to buy controlling stake in Peugeot scooter unit

- Luxury carmakers hindered by Indian potholes

- Global car groups to rev up India exports

- Nissan considers introduction of electric cars in Thailand

- Japan disaster affects Indian car production

- Indian auto boom gets bubbly

- India doesn't need green cars: Environment minister

- Superbike sales rise as Harley Davidson enters India

- Micra marks Ghosn's bid to make up for lost time

- Foreign luxury cars: Picking up speed in India

- Maruti Suzuki plans to drive into MUV segment

- In India, 'green cars' look like a hard sell

- Ford makes push to boost Asian presence

- Harley-Davidson plots India sales drive

- Harley-Davidson set to finally ride into India

- Superbike sales speed up in slowing economy

- 25 years later, second small car revolution

- India's car makers see glut

- PSA again exploring India opportunities

- Tough Times for the Tata Nano

- Can small really be beautiful?

- India cranks out small cars for export

- Will Tata's great car gamble backfire?

- Can Tata rev up Jaguar?

- Tata unveils world's cheapest car

- Automakers come knocking

- Coming soon, the $5000 car

- India's automotive plastics use to rise

- China readying new taxes on gas guzzlers

- New cars for under $5000

- At the Beijing Auto Show, signs of a behemoth to come

- Chinese automaker plans assembly line in Malaysia

- Chinese firm plans car plant in Malaysia

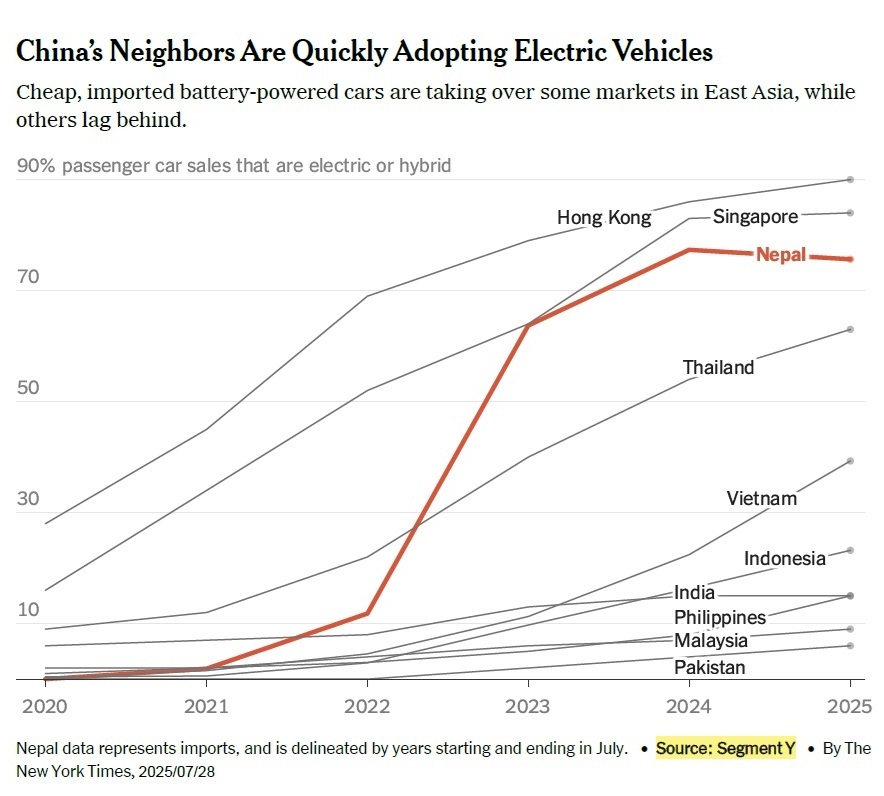

Nepal's EV surge - 76% of passenger vehicles electric amid rapid shift

nytimes.com, 29 July '25The narrow streets of Kathmandu, originally designed for pedestrians and rickshaws, are now congested with traffic.

Buses, motorbikes, small trucks and taxis fill the valley with constant noise and exhaust. For the city's more than three million residents, travelling has become difficult and uncomfortable.

Electric vehicles (EVs) have recently entered the transport mix. EVs now operate on city roads with minimal noise, and dealerships are recording increasing sales. Charging stations on highways have also been established, some of which include cafés for drivers waiting to recharge their vehicles.

The transition is advancing. In the past year, EVs accounted for 76% of all passenger vehicles and 50% of light commercial vehicles sold in Nepal. Five years ago, this figure was negligible. Nepal's EV market share is now exceeded only by a few countries, including Norway, Singapore and Ethiopia. The global average stood at 20% in 2024.

This increase is linked to government policies aimed at using Nepal's hydropower resources, decreasing reliance on imported fossil fuels and addressing air pollution. The trend has also been influenced by China, currently the largest manufacturer of battery-powered vehicles.

"Using electric vehicles is a comparative advantage," stated Mahesh Bhattarai, Director General of Nepal's Department of Customs. "It benefits the country. Chinese EVs are expanding globally, and the same is occurring in Nepal."

This differs from policies in the United States and Europe, where restrictions have been placed on Chinese EV imports in order to support domestic automotive industries. Nepal's situation is being observed by other developing nations seeking to manage growth and environmental issues.

The International Energy Agency projects that one billion additional vehicles will be on the roads by 2050, most of them in low- and middle-income countries. The extent of EV adoption in these regions will influence future air pollution levels and greenhouse gas emissions.

"It is important to ensure that this rapid growth in emerging markets does not replicate the environmental impacts experienced by developed markets," said Rob de Jong, Head of Sustainable Transportation at the United Nations Environment Programme.

Despite the progress, Nepal faces several challenges. Substantial financial resources have been committed to EV subsidies, and reducing these incentives prematurely could affect the pace of transition. In addition, addressing urban air quality will require the electrification of public transport, not just passenger cars.

The Asian Development Bank (ADB), which has supported Nepal's hydropower development, transmission infrastructure and charging networks, has advised caution.

"Given the economic rationale of this EV transition for Nepal, major policy reversals appear unlikely," said Arnaud Cauchois, the ADB's Country Director for Nepal. "However, this expectation is more a hope than a certainty."

From Indian petrol to Chinese cars

Multiple countries are working to transition to electric vehicles, and in Nepal, this strategy is supported by access to hydroelectric power from Himalayan rivers.

A border blockade imposed by India in 2015 disrupted Nepal's petroleum imports, which were then the country's primary energy source. Following this, the government increased investment in hydropower and grid infrastructure, resulting in broader access to electricity and the end of regular power cuts.

To utilise domestic electricity, Nepal required an increase in EV adoption. However, due to high upfront costs and a per-capita GDP of approximately US$ 1,400, affordability remained a barrier. The government introduced a range of incentives to encourage uptake.

As Nepal's main revenue source is import taxation, the government reduced customs and excise duties for EVs to a combined maximum of 40% in 2021, compared with 180% for petrol-powered vehicles. Consequently, an electric version of a Hyundai SUV now costs less than US$ 38,000, while the petrol-powered version is priced at approximately US$ 40,000.

The Nepal Electricity Authority (NEA) established 62 charging stations in Kathmandu and on major highways. It also allowed private parties to build charging infrastructure, imposed minimal import tariffs on necessary equipment and supplied free transformers.

The government further set electricity rates for EV charging below market levels. Under this pricing, refuelling a petrol-powered car costs approximately 15 times more than charging an electric one. This cost difference has encouraged hotels, restaurants and other roadside businesses to install their own charging stations.

"Initially there was apprehension about the viability of the infrastructure," said Kul Man Ghising, former Managing Director of the NEA. "But persistence eventually paid off." According to the NEA, businesses have now installed around 1,200 charging points, with additional units believed to exist at private residences.

EV adoption and market competition

Automotive dealers were initially hesitant. Yamuna Shrestha, formerly a distributor of BYD solar equipment, began distributing the company's EVs after visiting its Shenzhen headquarters in 2016. She obtained the dealership licence a few years later when EV market prospects in Nepal were limited.

"Many people were still advocating for fossil fuels, but there was little support for electric vehicles," said Shrestha. Her sales increased after BYD introduced models with greater driving range and sufficient ground clearance for Nepal's road conditions. She currently operates 18 dealerships and has projected sales of 4,000 vehicles in 2025.

The market has since grown more competitive. Numerous Chinese brands have entered Nepal, and Indian vehicle dealers report difficulty competing on both price and perceived quality.

"There is a geopolitical dimension to the influx of Chinese EVs," said Karan Kumar Chaudhary, a Suzuki dealer and President of the Automobiles Association of Nepal. "Consumers are seeing vehicles that rival Tesla's models at half the price. From the consumer's point of view, this is beneficial."

Jit Bahadur Shahi, a retired police officer, purchased an electric minibus for US$ 33,000. He uses it to transport passengers between Kathmandu and Janakpur, a seven-hour journey, and anticipates repaying the vehicle loan in four years.

"The main challenge is the lack of charging stations," Shahi noted. He also raised concerns regarding maintenance costs and battery replacement once the warranty period ends.

Concerns have emerged that Nepal may be slowing its EV transition. The country has had three prime ministers in the last five years, leading to fluctuating policy priorities. Recently, the central bank increased down-payment requirements for EV loans, and the federal government has incrementally raised EV import tariffs to address declining revenue.

Nepal does not yet have a formal battery recycling or disposal system. Additionally, there are concerns that low-quality imports from smaller manufacturers could negatively affect public perception of EVs. Some stakeholders are calling for an independent agency to certify vehicle safety and quality standards.

Rajan Babu Shrestha, the distributor for Tata Motors in Nepal, noted increased demand for electric models. However, he stated that market progress could reverse if tariffs rise or support for charging infrastructure is withdrawn.

"The direction is positive, but long-term policy stability remains uncertain," he said.

EVs and public transport

While private EV adoption is increasing, the majority of Nepal's population does not own cars. Most rely on motorbikes or diesel- and petrol-powered buses. Therefore, electrifying public transport is considered essential for reducing air pollution.

Chiri Babu Maharjan, Mayor of Lalitpur, a city adjacent to Kathmandu, acknowledged existing transport constraints. Widespread use of motorbikes contributes to congestion, and electric two-wheelers have not gained traction in Nepal as they have in India.

"We are working to reduce the number of fossil fuel vehicles," Maharjan said. "This is difficult, but necessary."

The municipality is depending on Sajha Yatayat, a state-majority-owned bus company, to provide alternatives. Electric buses are expensive, and fares are capped at around 36 cents for the longest trips, making the acquisition of such vehicles financially difficult. The government has allocated approximately US$ 22 million for procurement. Sajha Yatayat has operated 41 electric buses for the past two years.

Kanak Mani Dixit, the company's former Chairman, estimates that about 800 buses would be needed to establish a comprehensive service network.

The Chinese government has offered to donate 100 additional 12-metre electric buses. Dixit acknowledged that such assistance may serve multiple purposes, including the promotion of Chinese-made buses, but he expressed no objection to the support.

"Nepal has been receiving foreign assistance since 1950, and this is another instance of that," he said.

Addressing emissions from two-wheelers and improving public transport would require a regional transportation authority with the capacity to prioritise mass transit. Political disagreements have delayed its formation, although there are expectations that it may still be established.

"The Kathmandu Valley is ready for change," said Dixit. "Electric buses are being introduced, and the situation may be significantly different in five years."

All automotive data for this article has been sourced from Segment Y Automotive Intelligence.

The future of electric vehicles may ride on two wheels

Wall Street Journal, 25 Apr '20Inexpensive motorcycles and scooters will make up the largest group of new vehicles hitting the world's roads in the next decade-and a rapidly growing share of those bikes will be electric, say manufacturers and analysts.

With auto sales slowing in the biggest developed markets, electric two-wheelers may soon have their moment. Hundreds of millions of them will likely be sold in places like India, China and other emerging markets, according to projections from the Energy and Resources Institute, a New Delhi-based not-for-profit think tank.

Petrol-powered bikes still make up the bulk of two-wheeler sales, but companies like China's Nasdaq-listed NIU Technologies and India's Hero Electric Vehicles have begun offering reliable electric motorcycles and scooters at more affordable price points. Startups aiming to become the Tesla of two-wheelers are touting high-tech, sleekly designed models for less than US$ 2,000.

An electric-motorcycle boom could launch a new generation of drivers who prefer electric vehicles, and may be more likely to choose electric cars once they can afford them, say analysts and executives.

Electric two-wheelers are already having an environmental impact, according to the International Energy Agency (IEA), a Paris-based autonomous intergovernmental energy watchdog. Electric two- and three-wheelers on the roads avoided more pollutants than all electric cars combined in 2018, the most recent year for which data is available, according to the IEA.

"Electric mobility is not only about cars," said Marine Gorner, an analyst at the IEA. "Two- and three-wheelers electrify the fastest so, they have a significant role to play."

Electric options attracted Raghav Srinivasan, a Bangalore, India-based programmer who said he switched to an electric scooter from a petrol-powered one last year. With the styling and performance, the e-scooter is a better value than a similar petrol-powered vehicle, he said. "I didn't pick it for the environmental aspect," he said of his scooter made by Ather Energy, an Indian startup.

Dozens of new electric-vehicle models are expected to arrive at dealerships in the next few years. This report followed eight reporters in four countries to see if they, and the world, are ready to make the switch.

The coronavirus crisis has upended the transportation and energy industries, and a global recession could suppress demand as consumers put off purchases. The shift toward electric vehicles will continue nevertheless, industry executives predict. Some speculate that demand could rise post-pandemic if people seek alternatives to crowded public transportation.

China has offered perks for electric two-wheeler manufacturers and imposed restrictions on sales of those that run on petrol. More than 1.5 million electric two-wheelers were sold there last year, said Paul Blokland, director of Segment Y Automotive Intelligence, an automotive consulting company. Electric cars make up less than 5% of the car market in China today; electric two-wheelers comprise around 10%, of the motorcycle and scooter market, Segment Y estimates.

India, the world's largest two-wheeler market by annual unit sales, appears set to plug in next. Startups like Ather, established Indian brands like Bajaj Auto and global brands like Honda are helping electrify the nation's two-wheeler fleet and the government is pushing manufacturers to make more through regulations and tax breaks.

Falling battery prices have helped put electric two- and three-wheelers within 20% of the cost of their nearest petrol-powered competition. Going electric is often cheaper, said Naveen Munjal, managing director of Hero Electric Vehicles, India's largest electric two-wheeler brand. Mr. Munjal said Hero's mid-range scooters, which have a higher sticker price than comparable petrol-powered bikes, cost users 19% less over a three-year period when fuelling costs are factored in.

Reducing the number of petrol-powered vehicles is a public-health priority in India, which suffers the worst air quality in the world, shortening the lives of millions of its citizens, according to studies by the University of British Columbia and others.

More than 150 million two- and three-wheelers use the nation's streets, a figure expected to double in the next decade, estimates the Energy and Resources Institute.

India's government has said it wants 30% of new vehicles to be electric in the next decade, and it has even higher goals for two-wheelers. In China, the IEA estimates 90% of two-wheelers will be electric by 2030.

Hampering growth are higher sticker prices and the need to charge electric bikes. Of the 20 million two-wheelers sold annually in India, less than 2% are electric, estimates Segment Y Automotive.

Scooters made by Ather Energy are designed to withstand Indian driving conditions, with aluminium frames for stability and grouped wiring that won't rattle out of place as drivers zip around traffic jams and clatter over potholes and rutted roads. The company has set up charging stations in key markets and installs charging outlets in customers' homes and offices.

It has also tried to upgrade the scooter experience with keyless ignition and flat-panel displays, all for about US$ 1,600. "The idea is to build something that is as good or better" than petrol-powered scooters, said Ather's co-founder and chief executive, Tarun Mehta.

Hero Electric puts most of the wiring and electrical components high in its vehicles so they can cut through monsoon-flooded streets without shorting. The bikes' removable batteries can withstand 110-degree heat, and Hero has trained thousands of garage mechanics to change the tires on their vehicles. It also gives customers a way to stand out in a traffic jam, said Mr. Munjal.

"We give them green helmets to say 'I am the one making the change, I am a green warrior,'" Mr. Munjal added.

Chinese carmakers push to go global

Trefor Moss and Vibhuti Agarwal, Wall Street Journal, 11 August '19Chinese automakers are investing billions of dollars to establish footholds in foreign markets, from India to Africa and Europe.

China's car manufacturers once struggled to sell their cars at home, let alone abroad. Now, the cars they are producing are much improved, analysts say, matching foreign rivals on quality and outflanking them on price. Leading Chinese brands are aiming to capitalise by building their first major factories overseas, realising Beijing's long-held strategic ambition for homegrown car makers to become globally competitive players.

SAIC Motor, China's biggest automaker, in June began testing the Indian market with a new SUV called the MG Hector, releasing 21,000 vehicles it expected to sell over six months; the SUVs sold out in four weeks.

Dealerships had to turn away customers like Shiv Nagpal. Mr. Nagpal, who works in his family's jewellery business, said Chinese products have a good reputation in India. "Even the fancy iPhone is made in China," the 37-year-old said recently at an SAIC dealership in eastern Delhi. "We want to try a new Chinese brand."

China's automakers have the resources to back their overseas push, said Michael Dunne, chief executive of automotive consulting firm ZoZo Go. "They are ready to lose money for 10 years" to establish themselves, he said.

Their ambitions are growing even as U.S. auto makers have retreated from many foreign markets. Mr. Dunne, who ran General Motors' Indonesia plant from its opening in 2013 until it closed two years later, said: "Western auto makers insist on a path to profits within 36 to 48 months, and that's just not going to happen in a country like Indonesia," where it takes time to build a brand and grow market share.

The Chinese companies have a powerful incentive to move overseas. Even though their home market is the largest in the world, car sales are stagnating after decades of growth.

Companies going abroad face the painstaking process of brand-building and constructing local supply chains and national dealership networks, which can take years and billions of dollars to achieve. Also, many of the countries Chinese auto makers are entering are dominated by Japanese auto makers.

China has faltered in such efforts before. A decade ago, state-run FAW Group unveiled plans to conquer Latin America by building a factory in Mexico to assemble kits shipped from China. The venture fell victim to the global financial crisis and never got off the ground. In 2014, Chery Automobile, another state-owned player, invested US$ 530 million in a plant in Brazil. Sales never took off, and Chery put the plant up for sale in 2017.

The current crop of Chinese companies is more capable and mature, having built competitive businesses at home that are taking away market share from many foreign players. Ultimately, these companies are eyeing the U.S. and other well-off markets. For now, they are focusing mainly on developing economies.

State-run SAIC has opened plants in Indonesia and Thailand in the past two years, from where it plans to export across Southeast Asia. It is aiming for 1 million overseas sales a year by 2025. Great Wall Motors opened its first overseas plant in Russia in June. And state-owned BAIC Motor last year started production in South Africa, opening a US$ 772 million facility that is the biggest Chinese investment in Africa to date.

Zhejiang Geely Holding Group, which owns Volvo Cars, in 2017 opened its first overseas plant for its Geely brand in Belarus to serve Russia and Eastern Europe. Geely launched its first vehicle for the Southeast Asian market in December, following its 2017 acquisition of 49.9% of Malaysian auto maker Proton. And Geely's commercial electric-vehicle unit, London EV, began production at a new U.K. plant two years ago.

"Global expansion by Chinese brands is a natural growth plan," a Geely spokesperson said, recalling how Japanese and Korean auto makers transformed themselves into international brands in the 1970s and 1980s.

SAIC declined to comment. Great Wall and BAIC didn't respond to requests for comment.

In India, SAIC is being buoyed by the unexpectedly strong demand for its MG Hector, which is a retooled version of a hot-selling Chinese SUV, priced locally at around US$ 17,700. SAIC acquired MG, a century-old British marque, in 2007. It also bought GM's India plant a few years ago.

The company is banking on India's unrivalled potential: Only 3.5 million cars are sold there annually, a fraction of China's 28 million. But incomes are rising, and auto sales are forecast to grow with them.

SAIC has arrived at the right moment to tap into that, said Paul Blokland, director of Segment Y Automotive Intelligence. "The upside for the next 10 years is gigantic," he said. "If I'd been GM, I think I'd have stayed."

https://www.wsj.com/articles/chinese-auto-makers-go-global-as-sales-slow-at-home-11565524800

India's spending spree slows as debt problems become more widespread

Eric Bellman, Wall Street Journal, 28 August '19India's debt problems have spread to consumers, gumming up the most-important piston propelling Asia's third-largest economy and dimming its chances of snapping out of a slowdown.

India's gross-domestic-product growth has slowed to a five-year low and is expected to head lower.

Its strapped central government can't spend to help and banks are struggling and won't lend much. Now consumers, whose spending makes up more than 65% of India's economic activity, are turning more stingy. The government has scheduled August 30th. to announce GDP growth for the three months ended June.

With wage growth slipping and joblessness rising, the sales of everything from condominiums and cars to some soaps and snacks have taken a hit this year as the average Indian consumer has grown cautious.

One recent morning, around 100 construction workers and handymen were loitering on a corner of a busy South Delhi neighbourhood. Some had the tools of their trade on display - buckets full of paint brushes, bags full of tools or wires. The spot is a place where freelancers gather, hoping to get at least a day's work.

A few years ago, 250 people would gather at the corner, with nearly all snapped up for work by midday. Contractors would offer them twice the regular wages to help on projects across the city.

Today, those who remain say they are lucky if they get 10 days of work in a month. They have cut back on spending. Lakchand Ahirwat, 54 years old, is making a third of what he used to and is sending much less money home to his family in a village in Uttar Pradesh. He has had to tighten his belt, buying less wheat for his simple daily meal and ending luxuries like bidi cigarettes, biscuits and even bars of soap.

"I bathe with clothing detergent now," he said as his fellow handymen nodded nearby.

Even at this micro-level, India's great spending spree seems to be stuck. That could be bad news for global brands including Walmart Inc, Amazon.com Inc, Starbucks Corp and IKEA Group, which are all making big bets on India.

Indian lenders have accumulated one of the world's biggest piles of bad debt in the past decade as small and large companies borrowed for all kinds of projects that were never finished or failed to find the demand they expected. They have been selling assets and lending less to pare down the problem.

That lull in lending has led to more problems, as companies struggle to raise money to expand, families can't get home loans and consumers are unable to finance their purchases.

The debt problem has trickled down, first hitting infrastructure and real-estate development, then truck and car sales and finally scooter and motorcycle sales.

In the past four months, passenger car sales have plunged 21% compared with a year earlier while two-wheeler sales are down 13%. That's the deepest plunge in decades.

Even some of the most basic consumer goods have been hit by the decline in wage and employment growth. In the first half of this year, sales of bars of soap, toothpaste and biscuits have all fallen or slowed significantly compared with a year earlier, according to a data company. The downturn has been even more sharp in rural areas and for products that cost less than 10 rupees or around 14 cents, said an analyst at the earlier mentioned company.

"The disposable incomes are under threat," he said. "Consumers are really stressed and that is reflected in their buying."

The debt problems of India's biggest banks, shadow banks and companies are rippling through rural India because millions of farmers also work part-time in construction. The dip in construction means they are sending less money home or coming home and hurting wages there, a report released last week from HSBC said.

"Rural wages have been falling and rural unemployment has been rising," the report said. "All of this has pulled down consumption growth."

The day labourers of New Delhi concur.

Ajay Kumar Yadav, 32, is struggling to pay off a loan he took out in better times. He can return home only twice a year compared with six times a year before. He says he would consider moving back to his village in the state of Bihar but wages there have been slashed in half to 50 rupees a day.

He had to take one of his two children out of school in his village and the one going to school has just one school uniform, which his wife has to wash almost every day. "Now it's too difficult to buy two uniforms," he said.

Auto and confectionery makers have warned of thousands of layoffs unless the government does something to help them. Hindustan Unilever has lowered the prices of some of its best-selling soaps.

The government unveiled a package of confidence and economy bolstering measures last week, which included steps to lower lending rates. It also included ways to lower the cost of car ownership.

Spending on new vehicles will remain subdued until the spigots of lending are reopened since 30% of car purchases and 80% of motorcycle purchases depend on loans, said Paul Blokland, director of Segment Y Automotive Intelligence.

"The access to finance has to improve" for sales to rebound, he said. "Every sector has been smarting."

https://www.wsj.com/articles/indias-spending-spree-slows-as-debt-problems-become-more-widespread-11567014962

https://pressfrom.info/au/news/money/-144678-india-s-spending-spree-slows-as-debt-problems-become-more-widespread.html

India's manufacturing sector benefits from China's challenges

Economic Times, 15 Oct '15Play-Doh, Monopoly and practically all of Hasbro's other toys were made in China for decades. Now, Hasbro is changing course.

While the company still sources expensive, complex toys like the electronic FurReal Friends from China, Hasbro has contracts for production in Turkey, Indonesia, Vietnam and Mexico. It has moved most aggressively into India, where Hasbro now buys from several sizable factories, and another is planned.

Multinationals around the globe have begun to look seriously at manufacturing in India, with its plentiful and inexpensive labor pool. But the investment doesn't mean doing business in India is getting easier. Rather, it is a sign that doing business in China is getting more difficult.

The Hong Kong-based Musical Group decided to build the latest Hasbro factory in India after facing severe labor shortages and soaring wages at its main factory in southern China. But Musical, like many companies, is running headlong into India's bureaucratic morass over land purchases, and the project is months behind schedule.

"We've had a very tough negotiation with the local government," said Christopher Tse, the managing director of the Musical Group, which for nearly 35 years did almost all its manufacturing in China. "It takes more time than I expected."

For Prime Minister Narendra Modi, the situation presents a political and economic challenge.

More than a year ago, Modi, wearing a traditional bright yellow jacket and standing below an immense logo of an Indian tiger, unveiled an ambitious effort to ramp up manufacturing. The "Make in India" campaign promised to reduce bureaucracy and improve infrastructure, paving the way for big multinationals and other foreign investors. It was a cornerstone of his candidacy.

Since then, almost nothing has gone as planned.

Progress in improving the country's inadequate roads, rail lines and ports has been slow. Corruption remains pernicious. Urban air pollution is even worse in India than in China, and could deteriorate further as more factories are built.

Plans to rewrite labor and land laws, and to overhaul state taxes, have stalled in Parliament. And an effort by Modi to bypass Parliament with temporary executive orders has run into trouble as well.

Modi's most controversial but potentially far-reaching executive order - making it easier to convert farmland into factory sites - expired on Aug. 31. He chose not to renew it. The ordinance had become a political liability in state elections, as farmers feared that it might be used to push them off their land.

"Ease of doing business is still a work in progress," said India's finance minister, Arun Jaitley, adding that state governments were starting to reform land and labor laws.

Yet, slowly and a little unpredictably, India's manufacturing sector is starting to attract overseas investment.

Foxconn, the world's largest contract manufacturer of smartphones and other electronics, which has most of its factories in China, agreed in August to open 10 to 12 plants in western India by 2020, employing as many as 50,000 workers. A week earlier, General Motors announced plans to invest $1 billion to develop new car models for the Indian market and nearly double the size of its 7-year-old factory on the outskirts of Pune.

CNH Industrial of Italy is building an agricultural harvester factory nearby. Ford opened a sprawling car assembly plant in northwestern India this year, and Daimler has added an extensive assembly line for buses to its truck factory in southeastern India.

"If you're able to manufacture a world-class product in India, the economics of exporting are quite lucrative," said Rustom Desai, the managing director of Corning's India operations, which include a highly automated optic fiber factory here.

Indian officials see manufacturing as essential to their country's future. They have 10 million young workers a year joining the labor force and few alternatives to create enough jobs.

Devendra Fadnavis, an ally of Modi who is the chief minister of Maharashtra state that includes Mumbai and Pune, has been aggressively marketing his state's huge labor force in trips to China and elsewhere. "We have the human resources - if we can liberate them, we can pioneer the industrial production for the entire world," Fadnavis said.

The pitch has worked. Foreign direct investment in India is up 46% over the last two years. It is down 1.3% in China, although it shows signs of a modest rebound lately.

The recent flood of foreign investment is helping propel India, which is expected to be the fastest-growing major economy in the world this year. The International Monetary Fund estimated this month that India's economy would increase 7.3% in 2015, compared with 6.8% this year in China.

In many ways, India is benefiting from the challenges facing China.

Blue-collar wages in China have more than quintupled in the last decade and companies face worker shortages despite economic weakness. "If you want to hire 1,000 workers, you only find 600, and the turnover will be 15 or 20 percent a month," said Tse of Musical Group, the Hasbro supplier.

Some multinationals also worry that China is becoming a politically riskier place to do business. Such concerns have been heightened by the country's growing show of force, like the sight of thousands of goose-stepping soldiers parading through Tiananmen Square on Sept. 3, or the rapid construction of military-grade airfields this year on hastily built artificial islands in the disputed South China Sea.

By comparison, India offers a stable democracy and low wages. Even skilled factory workers here in Pune, sometimes called the Detroit of India, earn about $300 a month, half of Chinese wages.

Maintaining its edge won't be easy for India.

For one, India needs to significantly upgrade its roads, ports and other infrastructure. Musical Group initially considered building a factory about 200 kilometers (120 miles) outside Kolkata, formerly Calcutta. India's poor roads meant the trip would take four hours.

"In China, 200 kilometers is two hours," said Tse. He ultimately decided to seek costlier land a few miles from the port, only to encounter slow-moving local officials.

India is also trying to expand manufacturing just as global trade stalls. A big export push by India could prompt a backlash in other countries, said Raghuram Rajan, the governor of the Reserve Bank of India and former chief economic adviser to the Indian government.

"To expect another China to come in without any political reaction would be naive," he said in an interview in Mumbai. "We're going to have a much tougher fight for market share."

While many multinationals are enthralled by the potential of the India consumer, it may be difficult for the domestic market to absorb a lot of extra production.

At least four Chinese smartphone manufacturers - Huawei, OnePlus, Coolpad and Oppo - have said they plan to produce handsets in India, while Xiaomi is cooperating with Foxconn to assemble phones in India and Lenovo plans to work with Flextronics. As China's market approaches saturation, millions of Indians each year are buying smartphones for the first time.

But higher-end manufacturers like carmakers are still struggling to break into a market that has yet to create a broad middle class.

India's population has nearly passed China's. But automakers sell nearly 2 million cars a month in China, compared with 200,000 a month in India. The best-selling cars in India tend to be very inexpensive subcompacts manufactured by local companies like Maruti, not the larger but costlier models sold by the multinationals.

Even among the affluent, "someone who can afford an Acura will probably buy a Civic," said Paul Blokland, the director of Segment Y, an automotive research firm based in Goa, India.

Millions of Indians are on the cusp of affording cars, although most cannot do so yet. Vishal Rode, a 31-year-old autoworker earns $80 a week. He had to take out a three-year loan just to buy a $780 motorcycle, but is convinced that better times will come.

"I want to buy a car in the future," he said. "In the last 10 years, a lot of things have changed."

Uber's tricky vision aims to tempt Indians from car ownership

Financial Times, 26 Aug '15Uber likes to make bold predictions - as perhaps befits a six-year-old company with a valuation of more than US$ 50 billion. Travis Kalanick, co-founder and chief executive, says his ride-hailing service can become sufficiently ubiquitous in the west not only to kill-off old-fashioned taxis, but even to tempt some hardcore motorists to stop driving altogether.

In emerging markets, the company makes an even more eye-catching claim. Mumbai's battered old red buses are carrying adverts bearing the slogan: "The freedom to own a car, without ever buying one". These imply that Uber could become so widespread that millions of people might decide never to get behind the wheel at all.

At first, this sounds absurd. Some transport experts do claim that countries such as the US and the UK have reached a stage dubbed "peak car", whereby total vehicles use is starting to dip. But Indian car ownership remains tiny, at about 2%, according to research companies. This is far lower than in developed markets, where more than half of people tend to be drivers, as well as countries such as China.

Consequently, almost everyone agrees this level will rise dramatically. Analysts predict 4% of Indians will have cars by 2020. This in turn explains why General Motors unveiled plans to sink another US$ 1 billion into its loss making Indian operation last month, joining a host of global automakers gearing up for a future boom in car sales.

Yet Uber recently unveiled plans to invest US$ 1 billion into India, as well. This was partly to keep pace with Ola, its larger Bangalore-based rival. However, the splurge was also underpinned by a long-term bet, which Mr Kalanick outlined in a recent speech.

He argued that pollution and congestion leave cities in India and China facing an "existential" crisis. "We're offering a real alternative to a world that looks like a parking lot and moves like a traffic jam,' he said.

Tempting people away from cars is tricky. Vehicle ownership remains a powerful status symbol in emerging markets. That said it is not always a pleasant experience. Interest rates are high, making vehicle financing expensive. India's roads are bumpy and hectic. Parking is a nightmare. There is a reason why so many wealthy Indians employ drivers.

Uber's hopes of becoming chauffeur to the country's rising middle classes therefore rest on building a service that is both more convenient and cheaper than driving. It has a long way to go. Even in big cities like Mumbai or Bangalore, its service can be patchy, with much longer wait times than in New York or London.

Fixing that is mostly a question of supply. Uber has 150,000 drivers in India, but the idea that it could come close to 1 million over the next few years is not outlandish.

Ola predicts it will cross the million mark by 2017. The fact that only 2.4 million cars were sold in India last year gives a sense of the scale of the two companies' ambitions. This big potential increase in Uber's driver network was behind last week's tie-up with Tata, India's largest business group.

Tata invested US$ 100 million in the US Company. In exchange, it hopes its motoring and finance arm will provide vehicles, financing and insurance to all those first-time cabbies.

Different types of services can also help. In San Francisco, Uber offers a cheap carpool option, in which multiple riders hop in and out of the same vehicle. A comparable service is some way off in India, but could eventually find favour in a country where customers are thrifty, and shared taxis are already relatively common.

Take all of this together, and the idea that taxi aggregators might prise some of India's coming generation away from car ownership does not seem quite so ridiculous.

"Young Indian people living in big cities used to buy a small car," said Paul Blokland, of Segment Y Automotive Intelligence, an India-based research group. "But now they might well decide to save that money, given it is expensive, and they can't find anywhere to park it anyway."

This does not mean Uber's path will be easy, particularly given India's treacherous regulatory environment. But if even a small portion of future car buyers decide to rely on cabs, it could help car ownership levels settle well below the levels typically seen in mature industrial economies. And if Uber wins even a portion of this business, it will go a good way to justifying its US$ 50 billion valuation too.

Mahindra to buy controlling stake in Peugeot scooter unit

Financial Times, 07 Oct '14Mahindra & Mahindra is to acquire a majority stake in Peugeot Citroen's scooter division for €28 million (US$ 35 million), signalling a renewed phase of international expansion for both groups' struggling two-wheeler businesses.

India's third largest carmaker by sales on 7th October said it had signed a binding agreement to buy 51 per cent of Peugeot Motorcycles, the French car manufacturer's motorcycle unit.

Mahindra said the deal involved a €15 million cash injection as well as a €13 million shares purchase in the unit, which is also known as Peugeot Scooters and generated revenues of €99 million last year.

The sale is part of a wider turnround plan at Peugeot, Europe's second-largest carmaker by sales, which in July reported a return to profit in its results for the first half of 2014.

Mahindra described Peugeot's motorcycle division as "the oldest motorised two-wheeler manufacturer in the world", and "a key player in urban mobility in Europe for 116 years".

Shares in the Indian carmaker, which is part of the bigger Mahindra conglomerate, closed down more than 2 per cent in Mumbai.

The stake purchase in Peugeot Motorcycles is the latest in a series of attempts by Mahindra - best known for making inexpensive sport utility vehicles - to acquire global auto brands.

The Mumbai-based group bought South Korea's Ssangyong Motor in 2010, and has previously launched unsuccessful attempts to purchase Saab of Sweden and Aston Martin of Britain.

Mahindra said it would now "aggressively expand" Peugeot's scooter presence in developing economies including Vietnam and India, while attempting to arrest a sales slump in Europe.

Pawan Goenka, head of automotive at Mahindra, said its scooter division - which launched in 2008 and recorded a post-tax loss $75 million in 2013-14 - would push forward with plans for international expansion, including in African markets, aided by technology and design knowhow from Peugeot.

He added the company would now follow a "two-brand game" targeting Peugeot's scooters at higher-end customers while focusing Mahindra's range at entry-level consumers.

Mr Goenka denied that the deal was a prelude to any wider agreement with Peugeot's main carmaking business, whose financial difficulties led it to suspend plans to build a factory in India.

While Mahindra's Harvard-educated founder Anand Mahindra has often stated his enthusiasm for acquiring premier foreign brands, analysts said the Peugeot deal also stemmed from a desire to buy technology.

"[Mahindra] have found it hard to do the R&D for scooters themselves, the products they have developed haven't exactly set the market alight," said Paul Blokland of Segment Y Automotive Intelligence, an India-based research group.

India overtook China to become the world's largest motorcycle market by sales in 2012, according to a credit ratings agency, with an estimated 16m units expected to be sold this year.

The market has grown steadily in recent years - despite a contraction in car sales in 2012 and 2013 - driven by demand from lower income households in rural India, where motorbikes are popular for short trips.

Luxury carmakers hindered by Indian potholes

Financial Times, 22 Sep '14The Indian launch of Lamborghini's Huracán on May 2, featured exhilarating footage of a flame-red supercar, accelerating away from Mumbai's Taj Mahal hotel before roaring off down the city's main seafront boulevard.

Yet, despite high hopes from their manufacturers, sales of such luxury sports vehicles have proved disappointing of late, dashing expectation that India would soon follow China's recent period of rapid supercar growth.

Lamborghini "feels good" about demand for its newest model, says Sebastien Henry, head of Asia-Pacific operations at the company, which is owned by Volkswagen of Germany - even though it made just 22 of its 2,021 global sales in India last year. Rival Italian manufacturers such as Ferrari and Maserati, along with Britain's Aston Martin, have faced sluggish demand too, with an auto research group estimating that fewer than 250 supercars will be sold in the country this year.

High-end vehicles are meant to be expensive, but in India price is a particular problem. The Huracán, supposedly Lamborghini's entry-level offering, retails at Rs. 34 million (US$ 559,000), or around two-and-a-half times the cost in Europe.

All supercars are shipped in from abroad, meaning that recent import duty hikes, along with a decline in the rupee, have effectively doubled their cost, according to Lalit Choudary, the owner of Aston Martin's franchise in India.

Some companies have been especially unlucky, notably Ferrari, which launched in India in 2011 only to run into problems with their distributor. Ferrari severed ties with the distributor earlier this year.

A general economic downturn has hurt sales too, effectively capping the size of the high-end market, says Gautam Singhania, a wealthy textile tycoon and car enthusiast, who founded Mumbai's first supercar club. "Somebody like me from childhood always wanted a Lamborghini or a Ferrari, and when they first came to India I got one," he says. "But that demand is sucked up. The manufacturers need to do more to reach that next level of customer."

A more general limitation, meanwhile, comes from India's potholed roads - a factor likely to stop all but the bravest drivers testing Lamborghini's claim that the Huracán can race from zero to 100kph in a touch over three seconds.

"These things are plainly unsuitable for India, in contrast to China, where they built nice new highways," says Paul Blokland of Segment Y Automotive Intelligence, an India-based research group. "When India has a network of motorways, without bullock carts coming the wrong way down the outside lane, these cars will do better."

Others are less gloomy, however. India's economy is picking up, while import duties are set to fall. A roaring stock market has also doubled the number of India's dollar billionaires over the past two years, according to a research firm - creating a new group of wealthy potential purchasers.

India could benefit from forthcoming new luxury models as well. Germany's Porsche now makes most of its Indian sales through sports utility vehicles. The likes of Lamborghini, Bentley and even Rolls-Royce now plan to launch SUVs of their own, creating supercars more suited for India's tricky conditions.

These changes, as well as relatively low cost of sales, mean luxury car brands are likely to stick it out in Asia's third-largest economy, despite the tough conditions, says a consultant.

"Everyone wants to be here, because of the fat margins and the near zero overheads," he says. "For a brand selling a couple of thousand cars a year, even 20 or 30 cars from a country like India is a bonus."

Global car groups to rev up India exports

Financial Times, 09 Feb '14Global car companies including Volkswagen, Ford and Renault-Nissan are redoubling plans to transform India into an auto export hub and targeting vehicle shipments to Europe and the US as a hedge against shrinking demand in Asia's third-largest economy.

Hopes that India's once fast-growing market will soon rival China have been savaged over the past two years by a slump in car sales and rising costs following a sharp depreciation in India's rupee.

Many international motor groups, which have channelled more than US$ 8 billion into India since the mid-1990s, now view exports as the only answer to chronic oversupply in a country where vehicle capacity will more than double to 9.5 million by 2018, up from 4.5 million last year, according to a provider of automotive forecasts.

Volkswagen, the world's second-largest car company by sales, plans to nearly treble Indian exports to almost 55,000 units this year, having failed to achieve a breakthrough in the nation's ultra price-sensitive domestic market.

Mahesh Kodumudi, president of Volkswagen India, which already exports cars to about 30 countries and has found particular success shipping vehicles to Mexico, says that his company will consider exporting to Europe and America.

"We see tremendous potential for India to become an export hub, especially with the rupee weakening," he said at the 2014 New Delhi auto expo. "If I can export to Mexico, why can't I export to the United States?" he added. "Even Europe...it could be eastern Europe, western Europe as well."

US-based Ford is also increasingly focused on exports as it opens a US$ 1 billion factory this year, bringing the company's annual capacity to 440,000 vehicles despite selling only 77,000 in India during the last financial year.

Ford plans to export to more than 50 markets from its two Indian facilities including 10 countries for its successful EcoSport sport utility vehicle which it already plans to send to countries in western Europe.

Ford said it had "no specific plans" to export the EcoSport to the US but industry analysts said that the group was likely to consider the move.

"For Ford, it makes a great deal of sense to look to export to America," says the director of a New Delhi-based research group.

"Given how popular that car has been all around the world and how much spare capacity they are going to have in India...I think they will do it," he added.

Renault and Nissan, which operate in a global alliance, also hope to increase exports, having sent abroad more than 60% of the roughly 600,000 vehicles the duo has so far produced in India.

Indian auto-makers are projected to send abroad about 553,000 passenger and light-commercial vehicles by 2020, up from about 375,000 in 2011, according to an automotive consultancy service.

India's underused factories and geographic location see the country well-placed to supply emerging markets in Africa, Asia and the Middle East, analysts say but exports to Europe and even the US are also increasingly attractive.

"After the recession in the West, there is an increased focus on value... so it is perfectly possible that mid-range cars made in India, like the EcoSport, could find a good market in America or Europe," says Paul Blokland of Segment Y Automotive Intelligence, an India-based research group.

Nissan considers introduction of electric cars in Thailand

Alysha Webb,14 August '13Nissan is scoping out the electric car market in Bangkok.

It just signed a memorandum of understanding with the Metropolitan Electricity Authority there to test the Nissan LEAF.

"We have started by readying the infrastructure in order to make sure that Nissan's electric vehicle technology will respond to customer requirements effectively and gain positive response in the Thai market," said Nissan Motors Thailand president Takayuki Kimura.

A pure electric vehicle is unlikely to be popular with Thai consumers, said Paul Blokland, director at Segment Y, a Bangkok-based consultancy.

Bangkok is hot and humid. Temperatures soar to more than 100 degrees Fahrenheit in the summer and the humidity means running a car's AC full-blast most of the time. Now add relatively long commuting distances for many Thai drivers.

"These are not ideal conditions for electric vehicles," Blokland said.

To date, four LEAFs have been sold in Thailand, all in 2012, said Blokland. The LEAF might make sense in Bangkok as part of a "mobility package" that included another car, he said. "Whether that would fly in Thailand, I don't know."

Lower taxes on hybrid gas-electric vehicles - the non-plug-in variety - make then fairly popular in Thailand, said Blokland. "The Thai customer is not that interested in the technology but they like the fact that they can get a Camry or a Jazz [sold as Fit here] effectively at a discount," he said.

No plug-in electric vehicles are currently for sale in Thailand, said Benjamin Asher, an analyst at a provider of automotive forecasts in Thailand.

As for the suitability of the market for pure electric vehicles, he agrees with Blokland that demand is likely to be low among consumers.

People are moving to the suburbs and "long traffic jams with air-conditioning on full would no doubt take a toll on the battery," Asher said.

Though there is a trend for professionals who work in Bangkok to move to the city from the outer regions, that is usually a second home, he said. They buy a car so they can go home on weekends to see their family.

"So while the daily commute may be short, they would also want range to get back to their home-towns," he said.

Bangkok is not so different in that from another Asian cities like Beijing. There, traffic jams are terrible and commutes can be long, in time as well as distance.

Beijingers also often buy cars so they can get out of the polluted and congested city on weekends, so range will be an issue.

One advantage Bangkok does have over Beijing - some 70% of Bangkok's energy is from relatively clean natural gas. Most of Beijing's electricity comes from burning coal.

Let's not forget the Nissan LEAF and other electric cars have no tailpipe.

So even if consumers might be slow to adopt EVs, governments will recognise electric cars add no emissions to city air while long lines of other cars are stuck motionless in grid-locked traffic jams, idling and spewing pollution.

Japan disaster affects Indian car production

Outlook India, 28 May '11As Japanese auto players battle the aftermath of the earthquake and tsunami that hit their country in March, the global pecking order is set for an overhaul.

Last year, Toyota topped the global sales rankings with 8.42 million units, followed by GM with 8.39 million units and Volkswagen with 7.14 million units. This year, Toyota is expected to tumble to third place. General Motors (GM) is set to wrest back the No. 1 spot from Toyota, a position it lost to the Japanese carmaker in 2008.

"Normal production (for Toyota) is not expected to resume until November, and so total output is expected to lie somewhere between 6.5 and 7 million units, enough for third place," says Mr. Paul Blokland, Managing Director, Segment Y, an automotive research firm.

Toyota Kirloskar Motors (TKM) and Honda Siel Cars (HSCI), the India subsidiaries of Toyota and Honda, respectively, have announced production cuts in the wake of disruptions in component supplies from Japan. Toyota has said it will cut production by 70% between April 24th and June 4th at its two plants outside Bangalore. The company says production will drop by 10,000 units during this period.

The two plants, which have an annual capacity of 150,000 units, churn out the Etios sedan, multi-utility vehicle Innova, premium sedan Corolla Altis and sport-utility vehicle Fortuner. Toyota Kirloskar also sells the Prius hybrid and Camry sedans in India, but these are imported as completely built units (CBU).

Honda Siel will halve production at its plant in Greater Noida, where it manufactures the City, Civic and Accord sedans and Jazz hatchback, beginning May. "Honda is making every effort to work towards a full recovery after July," the company said in a statement. Last fiscal year, it produced 60,400 vehicles at the plant and recorded average monthly sales of slightly over 5,000 units. A 50% cut for May, June and July would thus result in a decline of 7,500 units.

Bad Times

The calamity could not have struck at a worse time for the two companies. Both have plans to launch small cars in India. This is a critical step as this segment constitutes 70% of the country's car market and neither player has a small car in its portfolio. However, the parts shortage has the potential to upset the launch plans.

Honda's small car, the Brio, was set for an October launch, while Toyota was planning to unveil the Etios Liva, the hatchback model of its sedan Etios, in June.

The Japanese players' supply problems are expected to benefit their rivals. Even before the natural disaster in Japan, all Toyota vehicles manufactured in India had a waiting period of one to three months. That is likely to go up, to the advantage of its competitors.

"We believe the biggest beneficiaries will be Volkswagen and Ford. Hyundai could also benefit as its new Verna directly competes with Honda's City," says another analyst from a consultancy firm.

While both the Japanese carmakers are putting up a brave face, their sales will continue to take a hit if the problem in Japan is not fixed in the projected time frame. "There is still a lot of uncertainty over when production for the auto industry can return to normal. We suspect the impact may be longer than most people expect," says media source. Over the long term, though, the two may be able to regain some lost ground.

The parts shortage is also likely to impact the growth of the Indian passenger vehicle industry as a whole, adds analyst from consultancy firm. "The shortage may knock off 2% growth in the Indian passenger car market this fiscal. We expect the market to grow at 11%-12.5% in 2011-12," he explains. Last fiscal, passenger car sales stood at a little over 2.5 million units, registering almost 30% growth over the previous year. It will take some doing to match that growth anytime soon.

Indian auto boom gets bubbly

Wall Street Journal, 30 August '10The chronic disease of the biggest auto markets in the world‒overcapacity‒could spread to India sooner than most people think. As everyone from Hyundai to Honda spends billions to rapidly ramp up their production here, sooner or later they will be making more cars than they can sell, say some experts.

"I see overcapacity even in the BRICs countries," said an executive of an auto consultancy. "The number of players (in India) has increased dramatically." The BRICs countries are Brazil, Russia, India and China.

That might seem hard to believe with car and commercial vehicle sales climbing to a record high of around 2.5 million in the year ended March 31, and in a country where just 12 people in 1,000 own a car or utility vehicle.

But it's an opinion that even some car manufacturers hold‒around one-third of the 200 auto executives who responded to a research survey out earlier this year predicted India would be struggling with overcapacity in the auto sector within the next five years.

It's still a minority view‒and hardly the 20% to 35% overcapacity companies are already dealing with in the U.S., Japan and Europe‒but it's something Indian auto executives (as well as investors and car buyers) should think about as they tune-up their plans in India. "Now there are 50 players in India and they are still building capacity."

But auto executives and analysts said that if the prices and products are right, India will have no trouble boosting passenger car and commercial vehicle sales. The research survey showed that 40% of respondents expect sales to climb to more than four million by 2014.

The real problem for auto companies in the not-too-distant future could be the lack of roads and parking spaces and possible rising fuel prices said, Paul Blokland, director of auto research company Segment Y Automotive Intelligence based in Goa.

"If you look five years from now then it may be impossible for people to use their cars or park their cars," he said. "That will be more of an issue than capacity."

India doesn't need green cars: Environment minister

Wall Street Journal, 28 August '10Environment Minister Jairam Ramesh, who grabbed headlines this week by blocking Vedanta Resources' mining plans in the eastern state of Orissa in order to protect forests and tribes there, dropped another bomb.

The government's protector of all things green told a gathering of the best and brightest of India's booming auto industry that electric cars and biofuels are probably no good for India.

While the popular Toyota Prius may be roaming Indian roads by the end of the year, there probably won't be very many people that love mother earth enough to accept the high cost and inconvenience of an electric car here.

Mr. Ramesh said to hundreds of auto executives and analysts assembled at the Society of Indian Automobile Manufacturers annual conference that electric cars don't make sense in India even for "green" drivers. Not only are they too expensive to be practical but they also lead to more (mostly coal-generated) electricity consumption which hurts the environment as well.

"I would urge the auto sector not to treat the environment as a speed-breaker," he said. Biofuels are also not the "silver bullet" for India's pollution problems, he said, because India needs to use its cropland to grow food not fuel. In India, automobiles only contribute around 7% of the country's greenhouse gasses.

A smarter way to lower auto emissions in India would be to promote the use of more fuel-efficient diesel engines, set strict emission standards and phase out old cars, analysts said, agreeing with Mr. Ramesh.

"Biofuels require so much land and India doesn't have land. With electric cars you just are just moving the pollution to a different location," said Paul Blokland, director of auto research company Segment Y Automotive Intelligence, an automotive-consulting firm based in Goa, India. "What would be a lot better is to get rid of the older vehicles."

India has around 18 million vehicles on the road today, of which close to one third are more than 13 years old, he said. As these cars on average pollute more than 20 times more than new cars, banning them from the road (or giving their owners incentives to trade them in for new cars and trucks) could cut India's emissions in half, Mr. Blokland said.

Superbike sales rise as Harley Davidson enters India

Livemint, 25th April '10In 2007, when Yamaha Motor launched the first superbikes-the R1 and MT01-in India, the company knew it was a shot in the dark.

There were no reliable estimates of the size of the market and the Japanese company would have to invest a lot of time and effort in creating the infrastructure required at dealerships to sell and market these bikes.

"We started selling them mainly for brand extension purposes," says Pankaj Dubey, national business head at India Yamaha Motor. Big numbers were never on the agenda, he says.

But with sales averaging about 100 units a year, Yamaha knew its decision to prise open the market would pay off soon. Quick to spot an opportunity, Suzuki Motorcycle India and Honda Motorcycle and Scooter India, both subsidiaries of Japanese auto manufacturers, also launched their best-selling models and Precision Motor India started importing Ducati motorcycles, adding to the imports of luxury Porsche cars.

They were joined last week by Harley-Davidson, which started accepting bookings for 12 models in India. On Saturday Japanese bike maker Kawasaki Heavy Industries announced the launch of India Kawasaki Motors that would import and assemble top-end bikes

Top-end bikes of the likes of Suzuki's Hayabusa and Honda's CBR1000RR are typically bikes with a large displacement of around 1,000cc that allows them to accelerate quickly and maintain speeds of up to 300km per hour if road conditions permit. Since they cost Rs. 950,000-1.3 million (US$ 21,400-29,300), they're only bought by passionate bikers

"We estimate the market for large capacity bikes to hover at 500 units this year," says Debsena Banerjee of Segment Y Automotive Intelligence, an automotive consultancy. He expects any drop in demand to be offset by Harley-Davidson. "The market is holding up well," he says.

In the past these bikes were imported by enthusiasts with the help of agents who typically brought in the product as spare parts, paying 24% import duty compared with 104% for the completely built up bike. There are an estimated 3,000 such superbikes in the country and owners complain that servicing them is a problem.

Suzuki, which started selling the Hayabusa and Intruder in January last year, says it only managed to sell five to six units a month initially. But sales have picked up to an average 15 units a month.

"Because of the increasing demand, we will expand the number of dealerships selling such bikes from seven to 12 across the country," says Atul Gupta, vice- president, sales and marketing, at Suzuki Motorcyle.

This year Suzuki will also launch the GSX R100 in India. The Hayabusa and Intruder have seen very high demand, according to Mohammed Imaduddin Farooqui, a Suzuki dealer in Hyderabad. Two weeks ago he ordered a black Hayabusa and was told he'd have to wait for two months.

N.K. Rattan, head of sales and marketing at Honda Motorcycle, also says sales have held up to the company's expectations. It too is averaging 100 units a year.

According to him the number is not a big issue. What's more important is the development of a biking culture in India, which companies like his are doing their best to promote. Honda plans to launch another superbike, the VFR100, by the end of the year.

In the last year sales of superbikes have also received another unexpected boost. The Directorate of Revenue Intelligence (DRI) has begun to crack down on superbikes imported without the right paperwork. DRI estimates there at least 700 such bikes across the country, an official has said.

Micra marks Ghosn's bid to make up for lost time

Livemint, 18 March '10The world's fourth largest auto maker, Renault-Nissan, opened its new car plant on March 17th in Chennai, where it will build the Micra as part of efforts to gain a share of India's small-car market, even as it makes up for lost time.

The alliance also plans to introduce a sedan variant of the Nissan Micra, a global small car made for developing countries such as India, Thailand and Mexico that will also be exported to Europe and Africa from the plant in Oragadam, near Chennai, that was commissioned on 17th March.

Renault SA aims to launch more small cars in India as Carlos Ghosn, chief executive of both companies, fortifies his India plan, currently restricted to the Logan, which it makes with Mahindra and Mahindra.

"Just as Nissan came up with the Micra, you can expect Renault to come up with an offer for the B, B+ segment soon," said Marc Nassif, managing director of Renault India, referring to a range of hatchbacks dominated by Maruti Suzuki, Swift and Hyundai's i10.

Ghosn expects the Micra, sales of which will begin in June, to boost the alliance's fortunes as the Indian market is dominated by small cars.

The alliance's moves in the Indian market come as competition in the small-car segment gets tougher; in the last quarter, all car launches have been in this segment. General Motors launched the Beat in January, followed a month later by Volkswagen with the Polo. Last week Ford launched the Figo. Toyota and Honda are preparing to launch their made-for-India small cars next year.

"They (the alliance) can catch up. India is still at the very beginning of where car sales will be 20-30 years from now," said Paul Blokland, director at Segment Y Automotive Intelligence, an auto consultancy. "So even if you enter 10 years later, catching up is possible."

Mahindra and Renault have been disappointed with the Logan's sales, which have plateaued to 4,981 units so far this fiscal.

"There are discussions at this point for the repositioning and further simplification of the car," Ghosn said at a press conference in Chennai on 16th March. "As soon as these discussions reach a conclusion, they will be announced."

Renault and Nissan Motor also plan to tap into the market for more expensive cars. The firm plans to start selling the Fluence sedan and the Koleos sports utility vehicle in India next year. Nissan has said it will launch nine cars, out of which five will be fully imported. Nassif said these cars would help build the brand while the small cars would boost volumes.

The alliance also plans to use the new India plant as a training base for workers at its plant in Morocco, delayed by a year due to the global slowdown and expected to open in a year. Both plants are almost identical and are designed to make cars of either alliance partner.

The Chennai plant, spread over 2.6 million sq. m, was built with an investment of Rs. 45 billion (US$ 990 million), about half or Rs. 23 billion of which has already been committed. The Morocco plant, coming up in Tangiers, is of similar size and will see an expected investment of US$ 1 billion. The formal training process is expected to kick off by the end of this year, Nassif said.

Ghosn said in his inaugural address that the Oragadam facility will serve as a benchmark for other company plants.

The Chennai plant will start mass production in May and is expected to reach full capacity utilization by 2012. The Chennai plant will export cars to 100 countries including 35 in Europe.

Foreign luxury cars: Picking up speed in India

Time, 12 January '10Not long ago, the only time luxury-car brands like Audi or BMW made an appearance in India was in movies or at auto shows like this one. Not anymore.

As the economy has grown, so has India's appetite for luxury automobiles, making it an important target for foreign automakers looking away from Western markets mired in global recession and whose streets are already bumper to bumper with cars.

"India is one of the markets of the future," says Paul Blokland, managing director of Segment Y Automotive Intelligence, an automotive-consulting firm based in Goa, India. "Manufacturers are looking for new growth markets. They're not going to find that in Europe, the U.S. or Japan."

What automakers have found in India is a country just entering the age of motorization, where still only 1% of the 1 billion‒plus population owns a car. Although India trails the world's largest emerging car market ‒ China ‒ its sheer size gives it untapped potential that carmakers can't ignore. A decade ago, Mercedes-Benz was the only luxury-car brand in India.

In 2006, BMW opened up shop, and it was soon joined by Audi. Though high-end business still only constitutes 0.5% of the overall Indian car market, the brands are already selling more cars than in smaller countries like Malaysia and Thailand, where Mercedes and BMW have been active for 50 years.

The numbers in absolute terms remain small: only 9,000 of the 1.8 million cars sold in India last year were luxury vehicles, but so far the slow and steady approach is paying off. "For all of these companies like Rolls-Royce and Lamborghini, sales have exceeded expectations," says Blokland. "They're all very happy with the sales they've done here."

Tapping into India's car market has always been a challenge for foreign automakers. Despite India's blistering economy, manufacturers have discovered a historic preference for cars that are small, fuel-efficient and cheap.

The sensation that is the Nano is well-known; its unveiling two years ago at the New Delhi Auto Expo by Indian automaker Tata captured the world's imagination and further focused attention on India's growing role in the global car market.

To be successful in India, small-car manufacturers have had to tailor their product to Indian tastes and conditions. When General Motors launched a new small car called the Chevy Beat in New Delhi last week, the company "Indianized it," says Karl Slym, president and managing director of General Motors India.

That meant toughening the car's suspension to deal with erratic road conditions. It also meant accommodating a slightly different driving style. "People like to drive away quick [from traffic lights]," says Slym. "They don't like anyone to get in front of them so your transmission has to allow you to move away from the lights quickly, but also has to allow you to drive in traffic in second gear."

Foreign luxury-car manufacturers, however, have vowed not to change their product and have faced unique challenges trying to get a foothold in the market. With few open roads to hit, but plenty of traffic jams to navigate, Indian consumers, unlike their Chinese counterparts, often opt for function over form.

Those who want a stylish ride pay for it dearly: import duties of more than 100% essentially double the sticker price of all foreign cars. To get around that, BMW and Mercedes assemble some of their models locally, cutting the taxes in half.

When BMW first arrived in India, it discovered that the customers who could afford a luxury car were not used to going out of their way to buy it, says Peter Kronschnabl, president of BMW India. In the past, a car would be sent to the home of a prospective buyer, who would decide by the look of it in the driveway whether to purchase it or not. So the company began investing in a larger network of dealerships, opening 18 showrooms around the country to woo potential buyers.

Because having a hired driver is also common practice among India's socioeconomic élite, BMW also had to change its sales pitch to suit a buyer who might never even sit in the driver's seat. "When we get in contact with a customer, we show the backseat as well," says Kronschnabl. "We don't only focus on the driving experience because the [hired] driver experiences the driving; the owner experiences the backseat."

Because the backseat rather than the driver's seat is a big selling point, unlike in most markets, bigger and more expensive BMW 5 Series sedans outsell the more affordable, smaller 3 Series models. This flexible approach has paid off for BMW, which finished the year as the top seller of luxury cars in the country. The competition, however, is good for everyone, says Kronschnabl, who expects the luxury market will more than double in size by 2015. "There's still pent-up demand," he says. "Everyone's growing, nobody's losing."

Maruti Suzuki plans to drive into MUV segment

Livemint, 6 January '10Not content with its leadership position in the small car market, Maruti Suzuki India plans to expand its product range to other segments, including multi-utility vehicles (MUVs), as it looks towards its next phase of growth and seeks to tackle increasing competition. At the 10th Auto Expo, India's biggest car maker unveiled new models and laid out a road map for capacity expansion.

Designed in India, Maruti Suzuki managing director Shinzo Nakanishi unveils the concept version of an MUV that is capable of carrying at least seven people, at the 10th Auto Expo in New Delhi.

The company is producing at full capacity at its plants in Gurgaon and Manesar in Haryana and expects to cross one million units in domestic sales and exports this fiscal, managing director Shinzo Nakanishi told journalists.

With the Indian car market forecast to double to three million units by 2015, Maruti Suzuki plans to raise its capacity to 1.5 million units to defend its leadership position of about 50% of India's passenger car market. Most of the expansion would take place at the Manesar facility. Nakanishi expects exports to stay flat at about 150,000 units per year by 2015.

Car makers, including Toyota Motor Corp., Honda Motor Co. and General Motors Corp., are seeking to challenge Maruti Suzuki's dominance and increase their share of the Indian market by introducing a slew of small car models, stepping up the pressure on the Indian auto maker to devise new strategies to power growth.

Maruti Suzuki unveiled the concept version of an MUV capable of carrying at least seven people. Named the R3, the MUV has been wholly designed by its research and development facilities in India.

With this, the company has plugged a crucial gap in its product portfolio and would be venturing into a segment that accounts for 13% of car sales in India. The R3 will be pitched against the Toyota Innova and the Mahindra Xylo-both runaway successes for their makers. MUV sales in India rose 40% to 91,782 units in the first eight months of this fiscal year.

Initial reactions to the R3 were positive. "It's an excellent product for the Indian market, where you need to pack in a lot of people in very little space," said Paul Blokland, director of Segment Y Automotive Intelligence Pvt. Ltd, a firm based in Goa. "What's important is this is the first time a car has been designed in India."

The firm hinted that the R3 would be put into mass production soon. "Typically it takes about 24 months to take a car from the concept stage to production," said I.V. Rao, managing executive officer (engineering) at Maruti Suzuki.

It also displayed the Kizashi sedan, which would mark its entry into the D-segment-generally defined as cars priced over Rs. 1 million (US$ 21,978). Sales are expected to begin by the end of calendar 2010, according to a company spokesperson.

To maintain its market share, the company plans to aggressively develop its marketing network as well as work on reducing the cost of producing cars. These cost savings could be passed on to customers, Nakanishi indicated.

The company is already working with vendors to reduce costs with the Alto hatchback and may pass these benefits on in the coming months. The Alto, India's largest selling car, sells over 20,000 units a month.

Maruti Suzuki's current stable of small cars would see models being refreshed at periodic intervals and new variants being added. In the last 15 months, Maruti has cemented its position in the small car market with the launch of the Ritz and A-star hatchbacks.